The Future World’s Largest Airport and Dubai’s Next Growth Engine

A $35bn expansion at Dubai World Central that will reshape aviation and real estate across Dubai South.

Dubai has spent decades building its reputation as one of the world’s leading aviation hubs. Dubai International Airport (DXB) handled a record 92 million passengers in 2024, reaffirming its position as the world’s busiest international airport. Yet even DXB has limits. To accommodate future growth in tourism, business travel, and cargo, Dubai is now committing to an even more ambitious project: the massive expansion of Al Maktoum International Airport (DWC) at Dubai World Central.

This development is set to reshape not only global aviation, but also the real estate landscape across Dubai South and beyond.

A $35 Billion Mega-Airport

Dubai’s leadership has approved an expansion plan for Al Maktoum International that will fundamentally change the scale of the city’s aviation infrastructure:

- The project involves investment of around Dh128 billion (US$35 billion) in a new passenger terminal and full airport expansion.

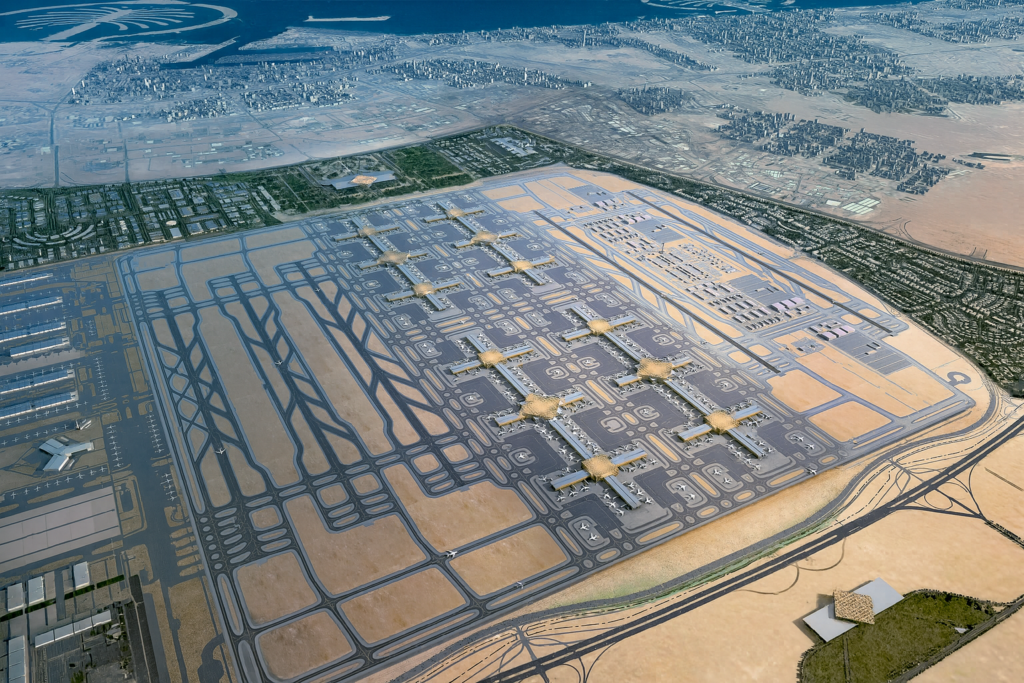

- The expanded airport is designed with five parallel runways and around 400 gates, making it one of the most advanced and largest airports ever built.

- Once complete, Al Maktoum International is expected to handle up to 260 million passengers per year, which would make it the largest airport in the world by capacity.

- Plans call for Dubai to gradually move the entirety of operations from DXB to the new mega-hub once the new facilities are ready.

Phase-one capacity is aimed at more than 150 million passengers annually, with further expansions taking it to the 260-million-passenger mark.

Redefining Dubai as a Global Hub

The expansion will reinforce Dubai’s long-term strategic position:

- It cements Dubai’s status as a primary crossroads between Asia, Europe, Africa, and the Americas.

- The airport is being designed around cutting-edge technologies, including biometric journeys, advanced automation, and smart logistics infrastructure.

- Analysts note that the project will set new standards in aviation infrastructure and global connectivity, strengthening Dubai’s role as a command centre for international travel and commerce.

For airlines and passengers, this means more routes, smoother connections, and greater capacity for new markets.

Real Estate Implications: Dubai South, Logistics Corridors, and Beyond

The Al Maktoum expansion will have a direct impact on real estate patterns:

-

Dubai South as a Primary Growth Corridor

The communities surrounding DWC—Dubai South Residential District, Expo City Dubai, and the logistics and aviation zones—stand to benefit from substantial infrastructure spending, job creation, and population growth. New residential, commercial, and industrial projects are already clustering around the airport precinct. -

Logistics and Industrial Demand

With expanded cargo capacity and world-class logistics facilities, the areas around Jebel Ali Port, Dubai Logistics City, and the wider south-west corridor are likely to see sustained demand for warehouses, light industrial assets, and Grade-A logistics parks. -

Hospitality and Short-Stay Accommodation

As the airport scales up to 150–260 million passengers annually, demand for hotels, serviced apartments, and short-stay accommodation in nearby areas is expected to rise sharply, providing opportunities for both institutional and private investors. -

Connectivity to the Rest of Dubai

Future metro extensions, improved road links, and integration with wider transport networks will make living near Al Maktoum International more attractive for residents who work elsewhere in the city.

Strategic Takeaways for Investors

For a Dubai real estate firm advising clients, the message around Al Maktoum International is clear:

- Think long term: The airport expansion is a multi-phase project aligned with Dubai’s 20–30-year growth horizon. Early investment in Dubai South and surrounding corridors may offer significant upside as infrastructure and operations ramp up.

- Focus on infrastructure-linked assets: Residential, logistics, and hospitality properties that directly benefit from new roads, metro lines, and airport facilities are likely to outperform the wider market over time.

- Diversify within Dubai: While established areas like Downtown, Dubai Marina, and Business Bay remain core investment districts, the Al Maktoum project creates a compelling case for diversifying portfolios into the south of Dubai.

As Al Maktoum International grows into the world’s largest airport by capacity, it will not only transform global aviation but also redefine Dubai’s southern districts as one of the most important economic and real estate hubs in the region.